Cash flow is a vital aspect of financial management for individuals and businesses alike. A cash flow chart, also known as a cash flow statement, is a powerful tool that provides a visual representation of how money moves in and out of an entity over a specific period.

In this article, we will explore the significance of cash flow charts, their components, and how they can help individuals and businesses make informed financial decisions.

| Quick Answer |

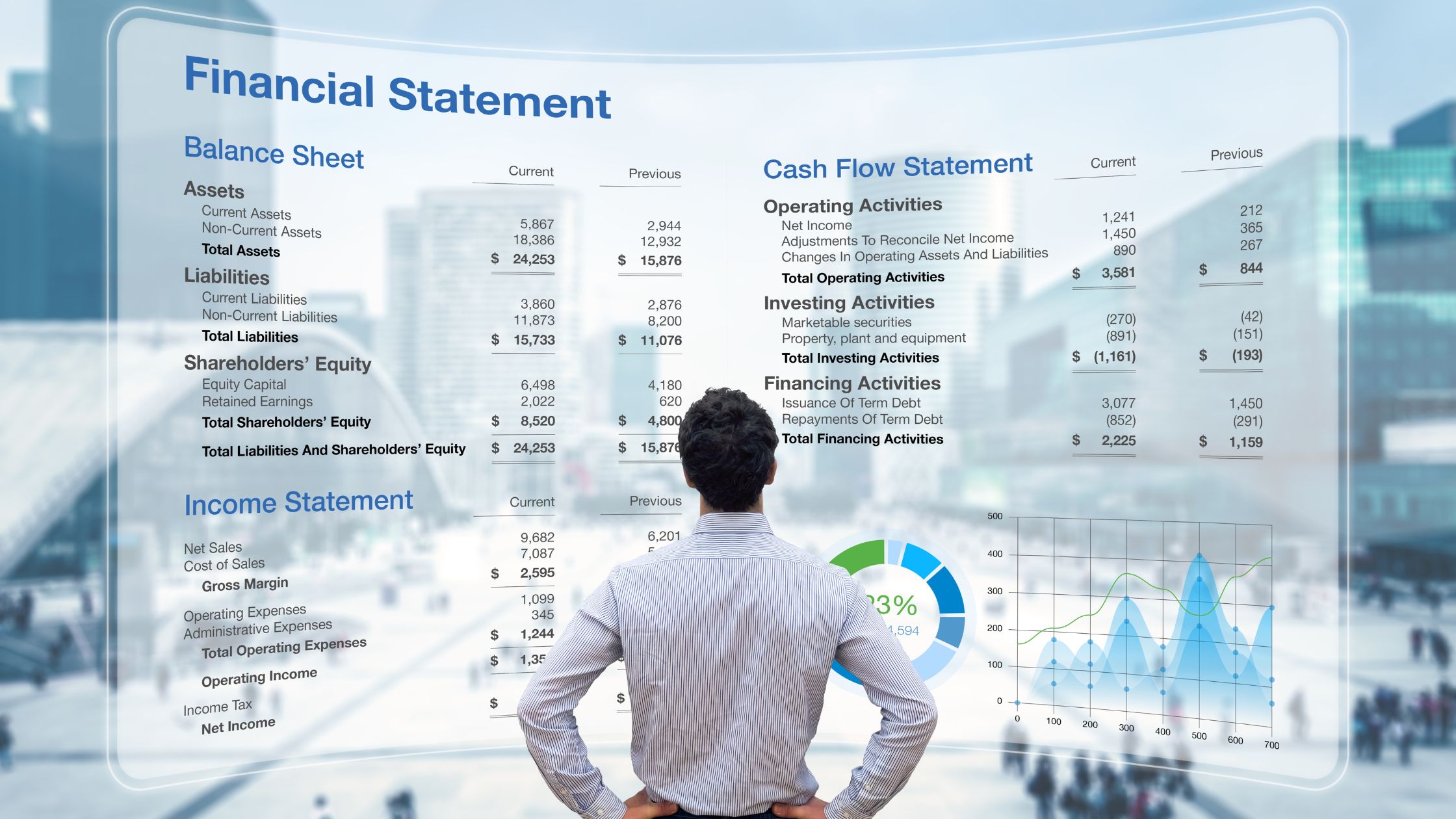

| A cash flow chart, also known as a cash flow statement, provides a visual representation of how money moves in and out of an entity over a specific period. It consists of three primary categories: operating activities, investing activities, and financing activities. Cash flow charts are created on a regular basis and help in financial decision-making, identifying cash flow issues, and building investor and creditor confidence. |

What is a Cash Flow Chart?

A cash flow chart is a financial statement that presents the inflows and outflows of cash during a particular period. It provides an overview of the sources and uses of cash, allowing for a clear understanding of how cash moves within an entity.

Cash flow charts are typically created on a monthly, quarterly, or annual basis and are a crucial part of financial reporting.

Components of a Cash Flow Chart

The cash flow chart is segmented into three primary categories: operational undertakings, investment ventures, and funding operations.

1. Operating Activities

Operating activities encompass cash flows generated from the core operations of a business. This section includes cash inflows from sales revenue, interest received, and dividends received. It also includes cash outflows such as payments to suppliers, employee wages, taxes, and other operational expenses.

Positive cash flows from operating activities indicate that the entity’s core operations are generating cash, while negative cash flows suggest that more cash is being spent than earned.

2. Investing Activities

Investing activities involve cash flows associated with the purchase or sale of long-term assets, investments, and other financial instruments. This section includes cash inflows from the sale of property, plant, and equipment, as well as cash received from the sale of investments.

On the other hand, cash outflows include the purchase of new assets, investments in other companies, and loans made to others. Positive cash flows from investing activities may indicate a healthy return on investments or asset disposals, while negative cash flows indicate investments made during the period.

3. Financing Activities

Financing activities represent cash flows related to obtaining or repaying capital. This section includes cash inflows from the issuance of stock, loans, or bonds, as well as cash received from shareholders as dividends.

Cash outflows consist of dividend payments, repayment of loans, or the repurchase of stock. Positive cash flows from financing activities signify an influx of capital, while negative cash flows suggest outflows to finance operations or repay debts.

How to Make Cash Flow Charts in Excel

Excel is one of the most widely used data visualization tools. Furthermore, it has been there for decades, so many people are familiar with it. However, the diagrams in this spreadsheet application are inadequate for displaying Cash Flow Statements. To obtain easy-to-read and intuitive Cash Flow Charts, use the ChartExpo add-in with this tool.

The tabular data shown below will be used.

| Income Source | Income Type | Income | Spending Source | Spending Type | Amount |

| Salary | Earned Income | Income | Deduction | Income Tax | 494 |

| Salary | Earned Income | Income | Deduction | Social Justice | 677 |

| Salary | Earned Income | Income | Core Expenses | Bill Expenses | 758 |

| Salary | Earned Income | Income | Core Expenses | Food | 933 |

| Salary | Earned Income | Income | Core Expenses | Personal Care | 649 |

| Salary | Earned Income | Income | Core Expenses | Transportation | 825 |

| Salary | Earned Income | Income | Financial Independence | Pension | 536 |

| Salary | Earned Income | Income | Financial Independence | Investment | 392 |

| Credit Card Reward | Passive Income | Income | Financial Independence | Real Estate | 287 |

| Dividends | Passive income | Income | Disposable Income | Emergency Fund | 262 |

| Interest | Passive income | Income | Disposable Income | Leisure | 147 |

Setup Steps

To begin with the Cash Flow generator ChartExpo for Excel, simply follow the steps below:

- Copy the above table into Excel.

- Open the worksheet and select “Insert” from the menu.

- Select “My Apps”, followed by the “See All button.”

- To begin the installation, click the ChartExpo button, followed by the Insert button.

- After you insert this add-in, you will see the list of charts below.

- You will locate the first chart as Sankey in the list, but if you cannot find it, you may search in the search box or click on the Category button to see a list of chart categories and then find the Sankey Chart.

- When you click on Sankey Chart, you will be redirected to a new window where you can select your sheet data and click on “Create Chart From Selection.”

- Your data will be converted into Sankey visualization immediately.

You can use the Edit Chart option to modify the nodes’ properties, including changing their colors, adding headings to charts, and adding prefixes and postfixes to the data.

Video Tutorial on How to Make Cash Flow Chart in Excel

The below video will guide you on how to create a cash flow in Excel with just a few clicks and without prior knowledge of coding.

Significance of Cash Flow Charts

1. Financial Decision-Making

Cash flow charts play a critical role in financial decision-making. They provide valuable insights into an entity’s financial health and help individuals and businesses make informed decisions. By understanding the sources and uses of cash, entities can identify potential cash shortages, plan for future investments, and make adjustments to improve their financial position.

2. Identifying Cash Flow Issues

Cash flow charts allow for the identification of cash flow issues. Consistently negative cash flows in operating activities may indicate a need to increase revenue or reduce expenses. Monitoring cash flow regularly can help entities identify potential cash crunches and take necessary actions to address them.

By promptly addressing cash flow problems, entities can avoid liquidity crises and maintain financial stability.

3. Investor and Creditor Confidence

Investors and creditors often rely on cash flow charts to assess an entity’s financial viability and stability. Positive cash flows demonstrate a healthy financial position and may attract investors or lenders.

On the other hand, negative cash flows can raise concerns and make it challenging to secure financing. Maintaining positive cash flow is crucial to instilling confidence in stakeholders and ensuring continued support.

Common Mistakes in Cash Flow Charts

1. Inaccurate Data Entry

One of the most common mistakes in cash flow charts is inaccurate data entry. It is essential to ensure that all cash inflows and outflows are accurately recorded in the appropriate sections of the cash flow statement. Errors in data entry can lead to incorrect financial analysis and decision-making.

2. Failure to Account for Timing Differences

Cash flow charts should consider the timing differences between cash inflows and outflows. It is essential to accurately reflect the timing of cash flows to provide a more realistic representation of an entity’s cash position. Failure to account for timing differences can distort the overall interpretation of the chart.

3. Ignoring Non-Cash Transactions

Cash flow charts should capture only cash transactions and not non-cash transactions. Non-cash transactions, such as depreciation or write-offs, do not involve the movement of cash and should not be included in the cash flow statement.

Failing to exclude non-cash transactions can result in misleading information.

Frequently Asked Questions

1. What is the difference between cash flow and profit?

Cash flow and profit are two different concepts. Profit refers to the surplus of revenue over expenses and is calculated using accrual accounting principles. On the other hand, cash flow refers to the actual movement of cash in and out of an entity.

While profit indicates the financial performance of an entity, cash flow provides insights into the availability of cash to meet obligations.

2. Can a business have positive cash flow but still face financial challenges?

Yes, a business can have positive cash flow but still face financial challenges. Positive cash flow does not guarantee financial success if there are other factors affecting the entity’s financial stability. For example, high levels of debt, inefficient cost management, or declining sales can pose challenges even with positive cash flow.

3. How can cash flow charts be used for forecasting?

Cash flow charts can be used for forecasting by analyzing past cash flow patterns and using them as a basis for future projections. By identifying trends, seasonal fluctuations, and potential changes in cash flow drivers, entities can make informed forecasts.

Forecasting cash flow helps in planning for future investments, identifying potential cash shortages, and ensuring adequate liquidity.

4. Can individuals benefit from creating personal cash flow charts?

Absolutely! Personal cash flow charts are valuable tools for managing personal finances effectively. By tracking income sources, expenses, and savings, individuals can gain insights into their financial health and make informed decisions.

Personal cash flow charts can help individuals plan for future expenses, identify areas where expenses can be reduced, and prioritize savings.

The Wrap-Up

Cash flow charts are powerful tools that provide a visual representation of an entity’s cash inflows and outflows. By understanding the components of cash flow charts and their significance, individuals and businesses can make informed financial decisions, identify cash flow issues, and ensure financial stability.

Regularly reviewing and updating cash flow charts is crucial for effective financial management and achieving long-term financial goals.